MasterCard and Visa Programs

1 MasterCard and Visa Programs

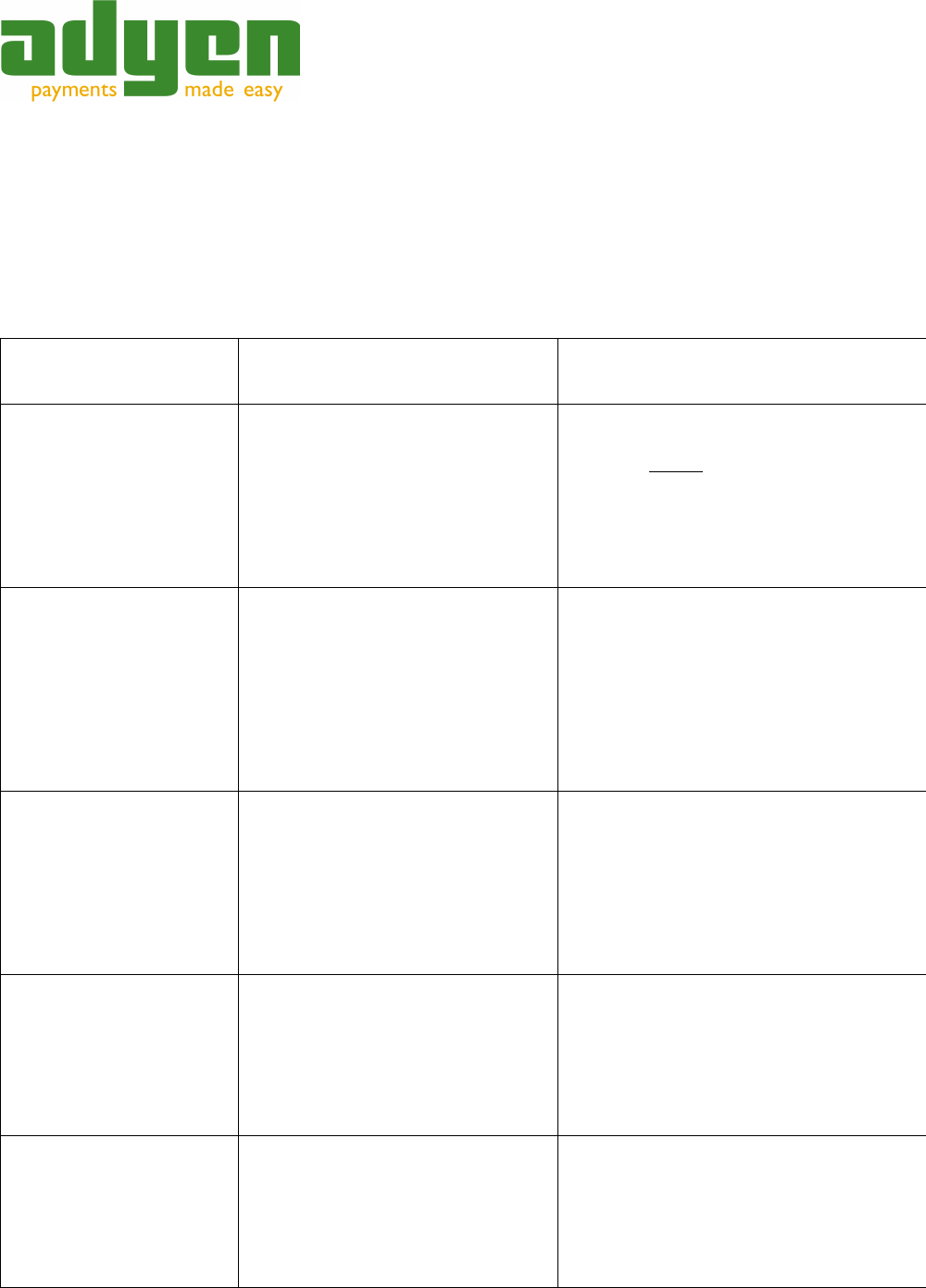

The table set out below explains the five different MasterCard & Visa programs

related to Fraud and/or Chargebacks:

Program Minimum Thresholds Potential Fines

MasterCard

Excessive

Chargeback Program

• CTR in excess of

1%; and

• at least 100 chargebacks

in 1 calender month.

• USD 25 per chargeback above

the allowable threshold; and

• A large Violation element

based upon the Issuer

recovery element and basis

point score above the

accepted thresholds for that

month.

MasterCard Global

Merchant Audit

Program

• 3 fraudulent transactions;

and

• At least USD 3,000 in

fraudulent transactions;

and

• A fraud to sales dollar

volume ratio minimum of

3% and not exceeding

4.9%

• USD 25,000 for not submitting

a special merchant audit

questionnaire.

Visa Global Merchant

Chargeback

Monitoring Program

• the number of charge-

backs in a single month is

more than 200; and

• the ratio of these

chargebacks to the

merchant's transactions

in the same month is

more than 2%.

• USD 100 per chargeback

• USD 200 per chargeback if the

merchant has not

implemented procedures to

reduce chargebacks (after

month 4)

Visa Global Merchant

Fraud Program

• $25,000 of reported

fraud; and

• 25 fraud transactions;

and

• 2.5% fraud-to-sales ratio

• 1

st

: USD 5,000

• increased with an other USD

5,000 for every month on or

above the performance

thresholds

Visa Regional

Merchant Fraud

Program

• $15,000; and

• 15 fraud transactions;

and

• 7,5% fraud to dollar sales

ratio

• No financial penalty only

chargeback window

4 Copyright © Adyen B.V. 2012