15

Manual VAT 1-3 system

This system provides the VAT calculation for taxable 1 through 3 subtotals. This calculation is performed using

the corresponding programmed rate when the

◊

key is pressed just after the

Ñ

key.

Manual VAT 1 system

This system enables the VAT calculation for the then subtotal. This calculation is performed using the VAT 1

preset rate when the

◊

key is pressed just after the

Ñ

key. For this system, the keyed-in VAT rate(0.0001 to

99.9999) can be used.

Manual tax 1-3 system

This system provides the tax calculation for taxable 1 through 3 subtotals. This calculation is performed using

the corresponding programmed rate when the

◊

key is pressed just after the

Ñ

key. After this calculation,

you must finalize the transaction.

Automatic tax 1-2 and automatic VAT 3 system

This system enables the calculation in the combination with automatic tax 1 and 2 and automatic VAT 3. The

combination can be VAT3 corresponding to taxable 3 and any of tax 1 and 2 corresponding to taxable 1 and

taxable 2 for each item. The tax amount is calculated automatically with the corresponding programmed rates.

• Tax statuses of PLU is depending on that of the department which the PLU belongs to.

• VAT/tax assignment symbol can be printed at the fixed right position near the amount on the

receipt as follows:

VAT1 VT1 Tax1 TX1

VAT2 VT2 Tax2 TX2

VAT3 VT Tax3 TX

When the multiple VAT/tax is assigned to a department or a PLU, a symbol of the lowest number

assigned to VAT/tax rate will be printed. For details, contact your authorized SHARP dealer.

Percent calculations (premium or discount)

• Your register provides the percent calculation for subtotal and/or each item entry depending on programming.

• Percentage: 0.01 to 100.00% (Depending on programming) (Application of preset rate (if programmed) and

manual rate entry are available.)

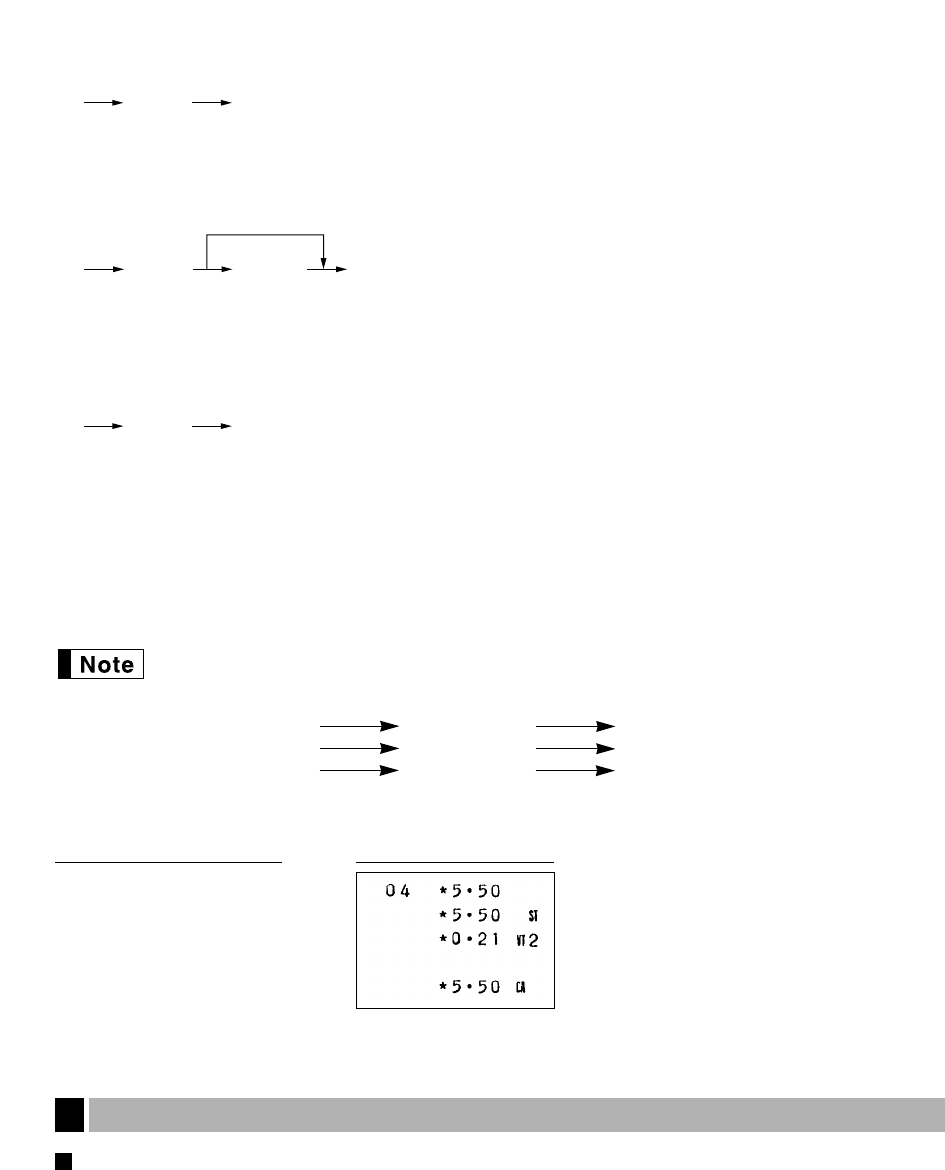

Auxiliary entries

5

550

ù

Ñ

(When the manual VAT

◊

1-3 system is selected)

É

PrintKey operation example